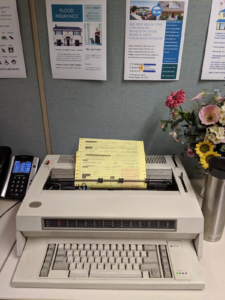

Having been working in insurance for over 30 years, I can recall the days of using carbon paper and typewriters. Back when I started, rating auto policies was done manually, with limited rating factors. Nowadays, rates are done through the computer using algorithms and it’s almost impossible to determine one’s rate. Rates are driven in a large part by credit, prior coverage history together with tickets, accidents and other claims going back as far as 5 years. Some companies even charge more for claims involving personal injury regardless of whose fault the accident was.

Interestingly, over all those years, the Assigned Risk really hasn’t changed it’s rating structure. The Assigned Risk is a state’s auto program that is designed to write people that have trouble getting insurance. Although I haven’t used the AR for years, I am beginning to now find that the AR or NYAIP can be a good fit in certain circumstances. This is because the AR does not base a rate on one’s credit or on having prior coverage. Furthermore, only tickets and at fault accidents, going back just 39 months, are rated. Not at fault accidents, hit and run accidents and no seat belt tickets are not rated. The AR also does not begin charging for a ticket or an accident until it is at least 3 months old.

Over the years, you may have accumulated some jewelry – from an engagement ring, expensive necklace to a finely crafted watch. You may also be looking into purchasing some new items of value. Either way, it’s a good idea to schedule these items on your Homeowners policy or to buy a separate jewelry policy to protect them. To learn more about the questions you should be asking regarding jewelry insurance, here is a some valuable information from one of our carriers, Safeco: https://www.safeco.com/blog/jewelry-coverage

You can also look on our Facebook Page at some posts we shared from Travelers, another carrier that provides jewlery insurance.

Lastly, if you have any questions regarding your current coverage and seeing about adding jewelry, feel free to call, text, or email us!

An ounce of prevention can save you your deductible. Over the years I’ve heard various types of water damage claims that clients have experienced. Partly because of this, I’m taking matters into my own hands as it relates to trying to prevent water damage at our home or office. Our properties are now heated via a baseboard system that runs a direct water feed line to our hot water heater and oil burner. Due to this change, I am able to install a cut off valve to all of the other piping that feeds the rest of the house and building so that when we leave, we can simply turn off that valve. This simple step reassures me that some random second floor pipe will not burst and create havoc in the form of water damage. Any essential piping can remain separate- such as those that feeds to sprinklers. A direct line still potentially minimizes your risk.

The cost of hiring a qualified plumber to add a few pipes and valves will be inexpensive compared to the resulting damage of a pipe burst. Another great solution is to add a water cutoff; this turns off the main valve when sensors become wet. Our properties already have these, but unfortunately, there are only so many you can add and they do not provide the same coverage as simply turning off the water. We have large deductibles to help reduce our premiums so I am always thinking about prevention and how to save money in the event of a loss. Having great insurance is so important and not having to use it is even better.

A car accident is typically exactly what it sounds like – an accident. The National Academy of Sciences published a study by TA Dingus et al. that found that distracted driving, which ranges from cell phone use to fatigue, has become one of the primary causes of serious car accidents. This shows that it is incredibly important to always be an attentive driver by staying focused, following the rules of the road while driving, and knowing when to pull over.

Relating to car accidents is the topic of today’s post- Supplemental Spousal Liability coverage. If you are married and live in New York State, we suggest adding this important coverage to your auto policy if you do not already have it. If you don’t know for sure whether or not you have it, take a moment to review the most current copy of your auto policy or contact our office to see exactly what you are covered for.

As the National Assoc of Insurance Commissioners explains, most NY auto insurance policies provide coverage for the injuries and damages of people and property involved in an accident. Policies also include uninsured/under-insured motorist coverage, which covers pain and suffering to you if you get into an accident with an at fault driver that has no or little liability insurance. The important thing to note is that, if you cause an accident, these coverage’s may not cover your spouse if they are injured in the accident. Supplemental Spousal Liability coverage fixes this lack of coverage by providing coverage for bodily injury or death of the spouse of the at fault insured driver. Please don’t hesitate our office today to see if your policy includes this coverage, to learn more about it or to get the price to add it to your policy.